how to lower property taxes in pa

After researching recent sales of comparable homes Larry and Joan d conclude. Checking out the tax bill itself can be an easy way to lower your property taxes.

:max_bytes(150000):strip_icc()/GettyImages-1369759122-67f7120b18bb4f8a8a5c0e3602cd2783.jpg)

Top 9 Tricks For Lowering Your Property Tax Bill

To qualify you must.

. This means that their annual property tax is 4000. A local Personal Income Tax of 185 which would be. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

How to lower property taxes in pa Sunday February 27 2022 Edit. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Two of the most.

If you live in Pennsylvania you can count on property tax exemptions for veterans as a way to lower your property taxes. On or about March 1 you will receive the bill for County and Municipal taxes. For example Philadelphia has been considering a 41 increase in property taxes for 2019.

135 of home value. For example in New Mexico the property tax rate is about 79 percent. If the tax rate is 1 Rocky and Adrianna will owe 2000 in property tax.

Be a Commonwealth resident. Get Ready to Wait. Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania.

The appeals board reduces that value to 150000. Tax bills are mailed to taxpayers twice a year. Fourth the replacement taxes for the 15 billion in school property taxes that must be replaced are made up of the following items.

A lower assessed property value would mean lower property taxes. The local tax rate is 10 for every 1000 of taxable value. This places it among the top fifteen US.

In fact the state carries a 150 average effective property tax rate in. County Board member Jim Zay proposed the property tax abatement during a County Board meeting in September after a presentation about the County having a surplus of. However to avoid having to raise property taxes city council introduced a package of.

Overall Pennsylvania has property tax rates that are higher than national averages. Property Taxes in Pennsylvania. The State of Pennsylvania has a high average effective property tax rate of 150.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed. The local tax rate is 10 for every 1000 of taxable value. Clark told the RGJ that its like the difference between two otherwise identical homes but one is on a noisy.

Property taxes in the Quaker State can do some serious damage to your wallet considering that the average property tax rate is 150. On or about July 1 you will receive the bill for School. The tax rate in the Pittsburgh.

1110 Kennebec Drive Chambersburg PA 17201 P. Property tax is determined by multiplying the property tax rate in your area by your homes current value. PA Property Tax Assessment From A to Z.

So they appeal the 200000 taxable value. You can likely obtain a free copy of your property tax bill from the local government offices. Tax amount varies by county.

As a state senator Mastriano introduced legislation that would eliminate property taxes for homeowners 65 and older who make less than 40000 per year and have lived in. Overview of Pennsylvania Taxes.

Sorry Pennsylvania Voters Your Property Tax Isn T Going Anywhere Tax Policy Center

How Seniors Can Get Discounts On Their Real Estate Taxes Marshall Parker Weber

Understanding Your Property Tax Bill Davie County Nc Official Website

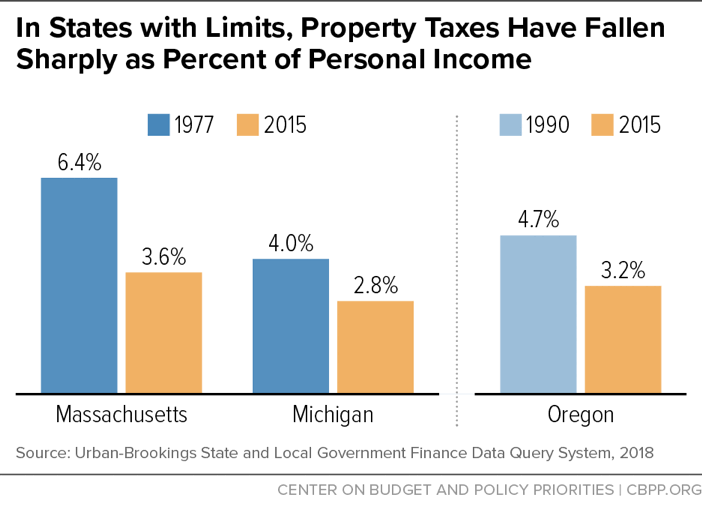

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

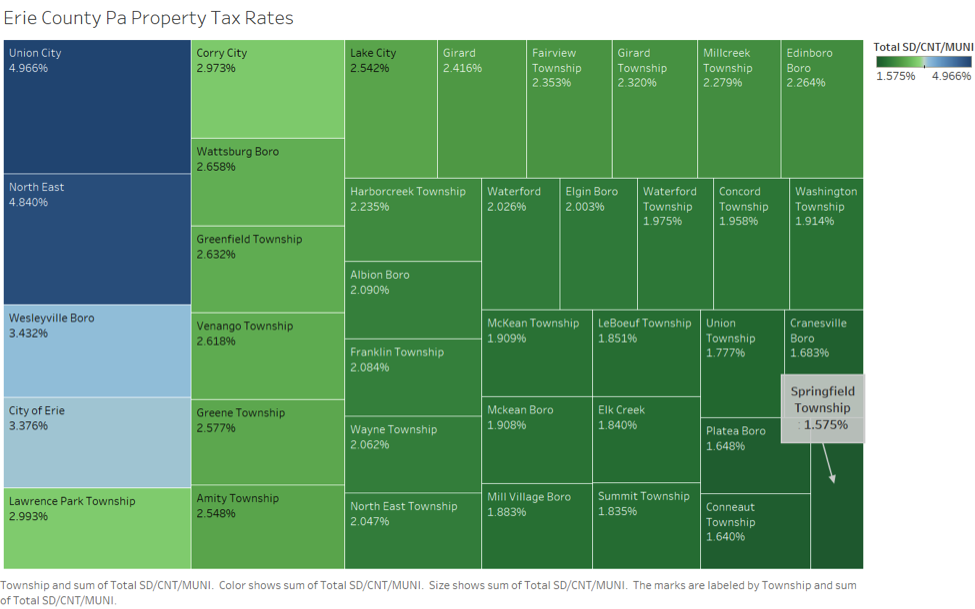

Guide To The Lowest Property Taxes In Pa Psecu

Prospect Of Pa Property Tax Elimination Is Not What It Seems

Pennsylvania Property Tax Calculator Smartasset

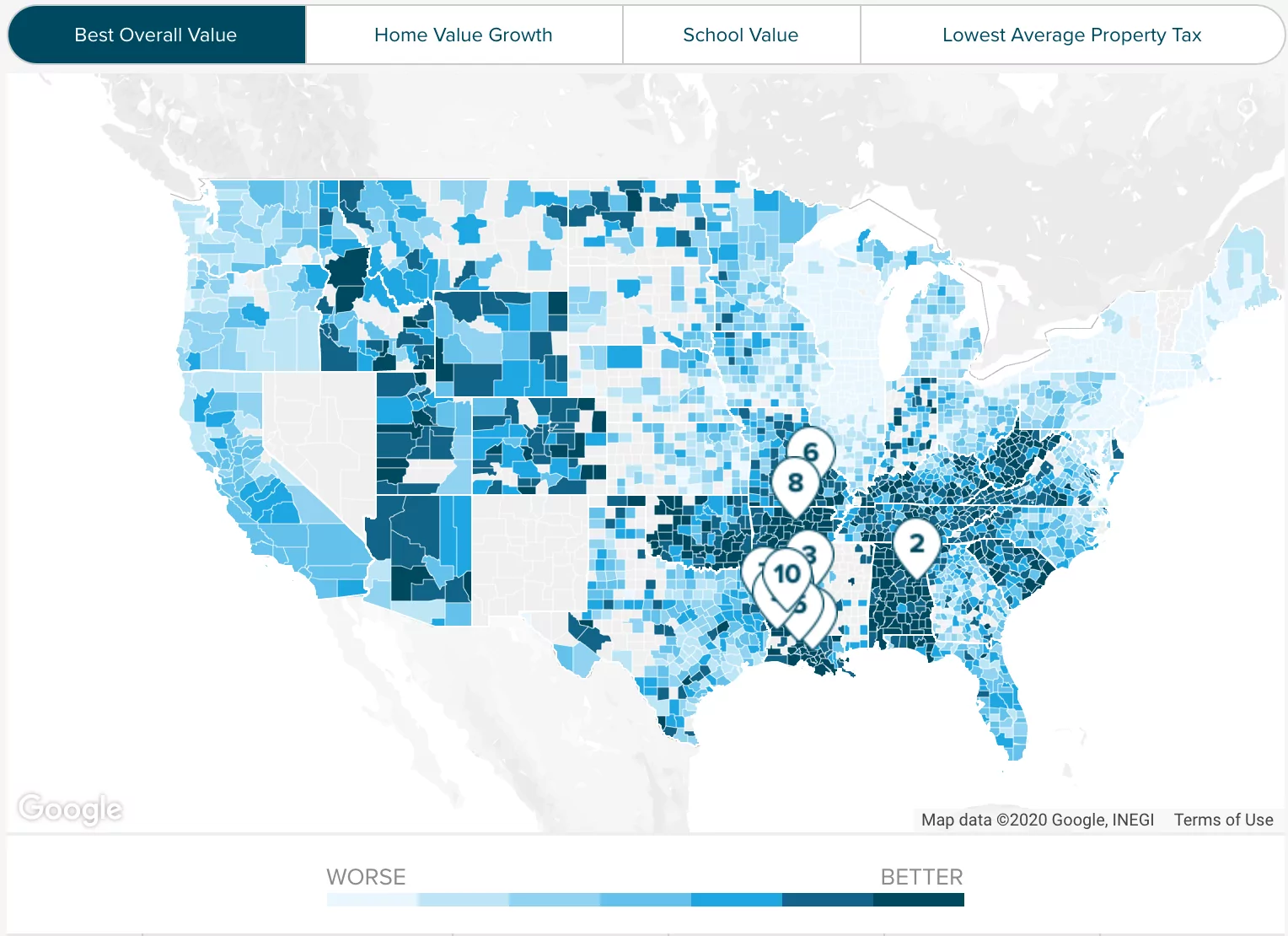

Property Taxes By County Interactive Map Tax Foundation

Non Glamorous Gains The Pennsylvania Land Tax Experiment

Reason To Worry Maywood Property Taxes Among Highest In Nation But There S More Village Free Press

Pa Election 2022 Where Governor Candidates Stand On Gas Tax Business Regulations And Property Taxes Pennlive Com

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Pa Property Tax Relief Pennsylvania Homestead Tax Exemption Youtube

How To Reduce Your Property Tax Bill In Philadelphia

Understanding Your Property Tax Bill Department Of Taxes

Washington County Or Property Tax Calculator Smartasset

Reduce Reliance On Local Property Taxes The Fourth Regional Plan