vermont department of taxes myvtax

NO FEE using myVTax. File or Pay Online.

6 sales tax 1 7 total tax.

. Vermont School District Codes. We would like to show you a description here but the site wont allow us. Vermont School District Codes.

Understand and comply with their state tax obligations. Chapter 211 Subchapter 7 Insurance Companies Questions. Taxes for Individuals File and pay taxes online and find required forms.

Taxes for Individuals File and pay taxes online and find required forms. Sign Up for myVTax. B-2 Notice of Change.

By Tax Type. Register file your return and pay taxes due at myVTax. If you have any questions contact our Insurance Premium Tax and Captive Insurance Premium Tax examiner 802-828-6838.

Voter Services Register to vote and find other useful information. PA-1 Special Power of Attorney. Sign Up for myVTax.

Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. You have been successfully logged out. 9 meals tax.

Local Option Sales Tax. Vermont Department of Taxes 133 State Street Montpelier VT 05633 Click here for phone numbers Local. Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am.

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm. See also 32 VSA. How do I contact Vermont Department of Taxes.

B-2 Notice of Change. You will be responsible for repayment of a property tax credit if issued. Local option tax is a way for municipalities in Vermont to raise additional revenue.

Tax examiners in this division can answer questions about Vermont personal income tax Homestead Declaration. This guide provides step-by-step instructions on how to complete the online version of Form LC 142 Landlord Certificate at wwwmyVTaxvermontgov. Fact Sheets and Guides.

Voter Services Register to vote and find other useful information. Locate a Vital Record Search and request certificates of birth death marriage civil union divorce and dissolution. Local Option Meals Tax.

DEPARTMENT OF TAXES Filing a Landlord Certificate online can save labor and time. How Can We Contact the Vermont Department of Taxes for questions about Vermont personal income taxes. PA-1 Special Power of Attorney.

You can also email myVTax support or call us at 802-828-6802 or 802-828-2551. IN-111 Vermont Income Tax Return. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

A municipality may vote to levy the following 1 local option taxes in addition to state business taxes. Use Form HS-122W available at httptaxvermontgov or calling 802-828-2515. Respond to Correspondence.

You may now close this window. We also have an instructional video available on our website. Department of Taxes Homestead Declaration and Property Tax Adjustment Filing No.

Fact Sheets and Guides. IN-111 Vermont Income Tax Return. If you purchase own and occupy a new home by April 1 2022 you are the one responsible for.

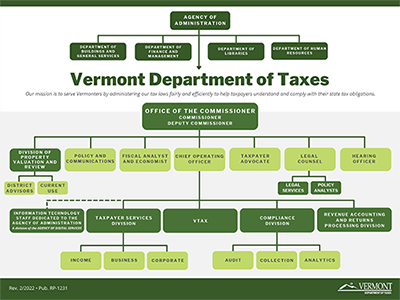

The Vermont Department of Taxes part of the Agency of Administration is tasked with the collection of taxes and enforcement of the tax laws of the State of Vermont. Department of Taxes httpsmyvtaxvermontgov_ No. W-4VT Employees Withholding Allowance Certificate.

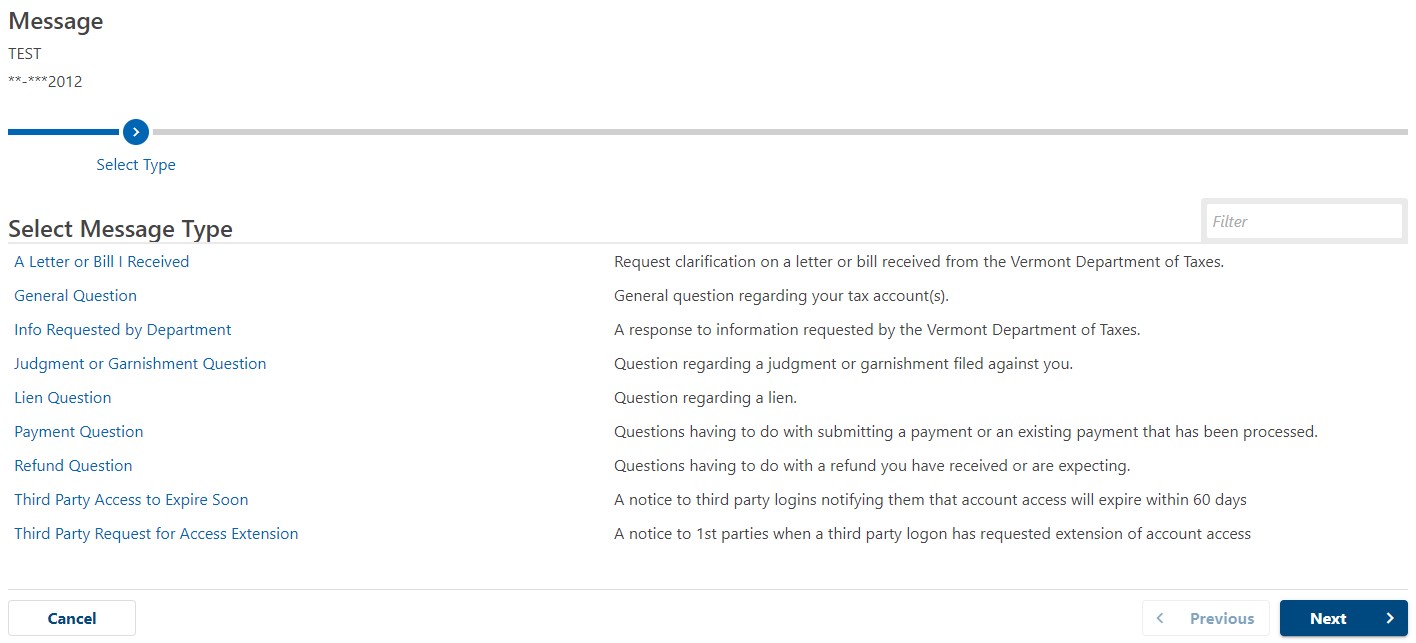

Vermont Department of Taxes Issues. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department of Taxes. Respond to Correspondence.

Please note that when you complete and submit your. By Tax Type. You can also use your credit card to pay on this site however there is a nonrefundable 3 fee which is retained by the service company.

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday. Locate a Vital Record Search and request certificates of birth death marriage civil union divorce and dissolution. W-4VT Employees Withholding Allowance Certificate.

FY2023 Property Tax Rates. Order tax forms or the Vermont Income Tax Return Booklet by 1 using the online form or 2 calling the forms hotline at 802 828-2515 or 855 297-5600 toll-free in Vermont or 3 emailing taxformsrequestvermontgov. For questions from licensed or authorized companies regarding tax forms filing due dates filing address and tax.

Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am.

Vermont Department Of Taxes Facebook

Publications Department Of Taxes

Vermont Department Of Taxes Facebook

Organization Department Of Taxes

Individuals Department Of Taxes

Vermont Sales Tax Small Business Guide Truic

Personal Income Tax Department Of Taxes